3 Common Mistakes First-Time Home Buyers Make

Purchasing a home can be exciting and stressful, especially for first-time homeowners. There are plenty of decisions to make, including budgeting and finding a contractor. With so much to consider, homeowners usually overlook essential factors like proper funding allocations and end up having to make adjustments later on. To help you avoid them, here are the most common mistakes first-time home buyers make:

1. Buying More Than You Can Afford

When a first-time home buyer receives loan approval, they tend to assume they can afford any house they were endorsed for. Although an initial mortgage approval estimates the property you may purchase, the cost can still change due to the difference between your debt-to-income ratio and monthly expenses. As a result, the amount you are authorized for may be higher than what you expect.

To have a more accurate idea of how much house you can afford and whether you need additional funds, review your debt-to-income ratio before signing any documents with your lender. Also, write down all your monthly expenses that might not have been considered during the initial approval process.

2. Spending All Your Savings

To be able to put a down payment and cover closing costs, many first-time home buyers deplete their entire savings. Although it is ideal to settle your deposits, spending all your savings on them may leave you with less wiggle room for unexpected maintenance costs and emergency expenses.

Therefore, save at least a few months' worth of living expenses after you pay the down payment and closing charges. It's also recommended to buy a few discount points on your mortgage to reduce your interest.

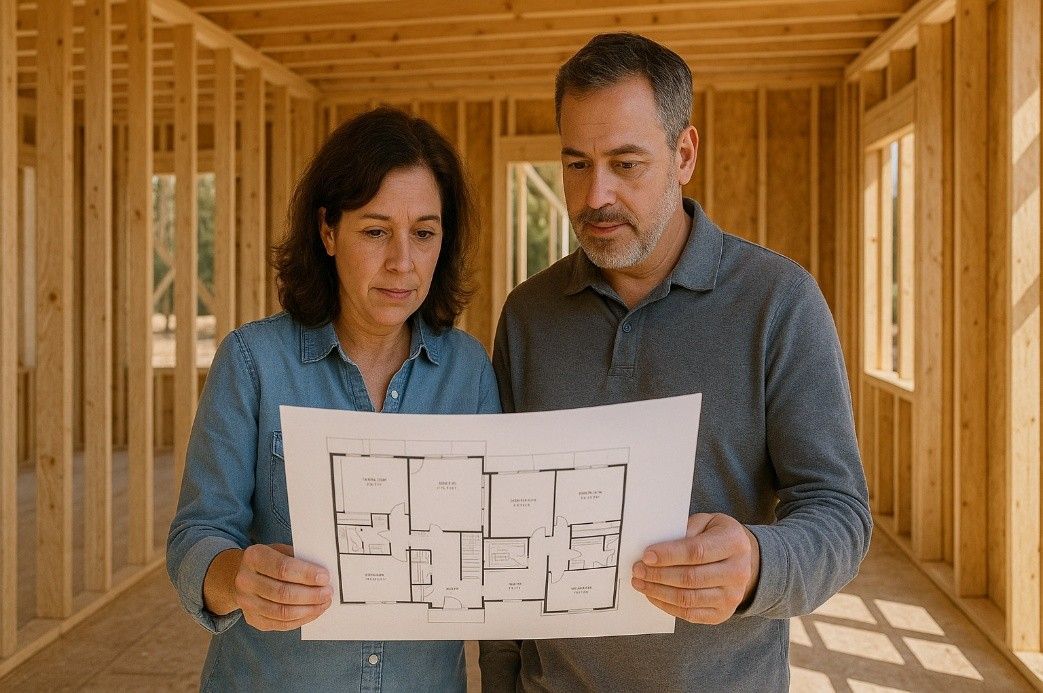

3. Settling on any Custom Home Builder

You shouldn't settle for just any custom home builder to design your home. Working with one who can't handle your project will only ruin your home.

Make every effort to research your potential builder's portfolio and references. You can also look at their online reputation and reviews or arrange an interview with your prospective custom home builder. This will allow you to check their experiences and past works and examine their quality.

Are You Ready To Start Home Shopping?

Buying a property is an exciting and significant achievement for many, but it can also be complicated and burdensome. However, with Bay to Beach Builders Inc., there's no need to worry. Our team of experts can guide you in your home buying journey and give you an idea about our home building process. Contact us today to schedule your appointment!