How To Finance Your Custom Home

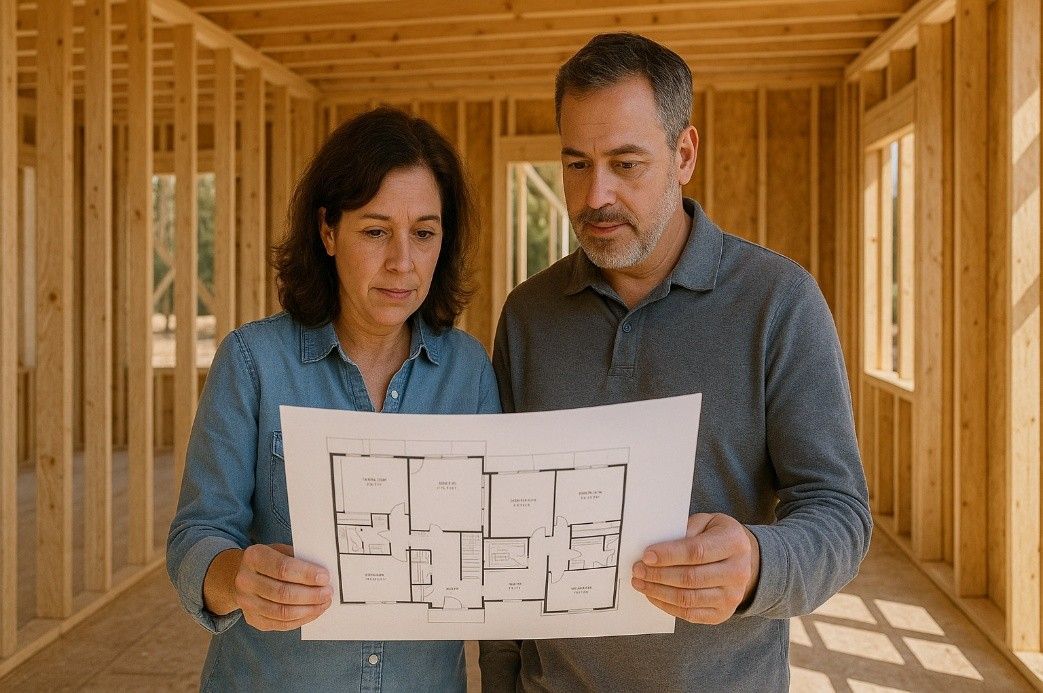

There are several factors to consider when planning a residential build, the chief of which is the costs of your house. Securing financing for your project is a pivotal part of the process, an aspect that involves three different transactions. These payments come in the form of the lot loan, the construction loan, and the mortgage loan.

While essential, financing a home is a topic that's not well-understood by every homeowner. If you have little to no idea about the various house construction loans involved, check out our FAQs about financing to help you navigate your next project.

Getting a Lot Loan

If you have yet to purchase land for your home construction, you can take a Lot Loan to secure a piece of property. The following are some key details about this type of loan:

- A standard lot loan has a duration that ranges from two to twenty years

- Options are available for either fixed or floating rates

- The value and location of the lot and the size of your down payment have a significant effect on land prices and interest rates

- Land located closer to a municipal center tends to be more expensive

- Most financial institutions offer this type of loan

Getting a Construction Loan

Securing a construction loan is a primary part of financing a home. This option has a standard duration of six to nine months, though the length varies depending on the project's scope. This type of loan requires a substantial down payment, often ranging from 15% to 20% of the total loan cost. Here are the different variations of construction loans:

- A standalone construction loan must be paid off upon the project's completion

- A construction-to-permanent loan (C2P) instantly becomes a standard mortgage upon the project's completion

- A renovation construction loan pertains to renovations of your home, and it can be a part of a traditional mortgage

As not all banks offer this transaction, you can ask your custom home-builder to help you find a bank that provides a construction loan.

Getting a Mortgage Loan

Most homeowners get a mortgage for their dream home. This permanent loan has interest rates and closing costs that change based on various factors, such as your financial position, the value of your custom home, and your creditworthiness. Some construction loans convert to mortgages upon the completion of the residential project.

Contact Bay to Beach Builders To Learn More About Building A Custom Home

Ask your builder if you need further help with financing a home project. Reach out to Bay to Beach Builders for quality residential design and construction services. You can visit either of our two idea home and design studios in Delaware to have a more comprehensive conversation with our team.